The 2025 tax season refunds have already begun, and taxpayers across the country are eagerly awaiting their returns. This year, there’s good news for eligible filers, as the IRS is offering a 5.2% increase in refund amounts. However, not everyone will qualify for a refund, as the IRS will ensure that all criteria are met before payments are issued.

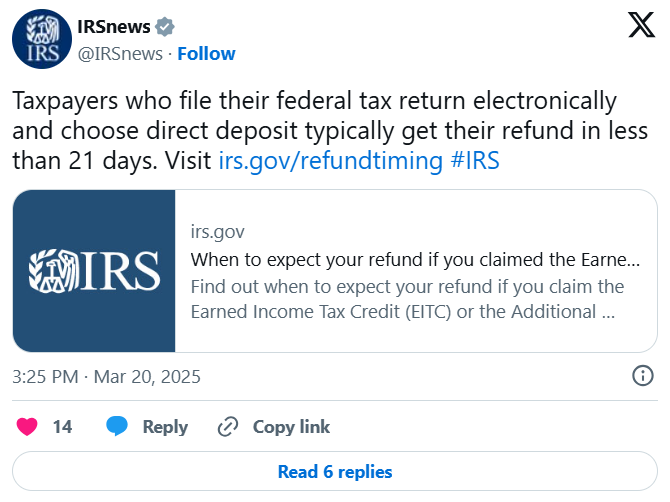

If you’re expecting a refund, it’s important to know that most taxpayers will receive their 2025 tax season refunds within 21 days. The average refund amount this season is $3,271, which reflects the 5.2% increase over the previous year. For those opting for direct deposit, the refund amount averages at $3,330, showing a 4.8% boost from last season. Refunds are calculated based on several factors, including your income, tax credits, and withholdings, which will be thoroughly checked by the IRS.

How to Ensure You Get Your 2025 Tax Season Refunds on Time

To get your 2025 tax season refunds quickly, you’ll need to file your return accurately and request direct deposit. Filing electronically and before the April 15 deadline will help you avoid delays or additional fees. The IRS will process your return and release the refund within the 3-week window if everything is in order.

How Tax Credits Affect Your 2025 Tax Season Refunds

Certain taxpayers, such as those with dependents, may receive a higher refund. Families qualifying for the Child Tax Credit or Earned Income Tax Credit could see a substantial increase in their 2025 tax season refunds. It’s crucial to know if you qualify for these credits to ensure you maximize your refund.

If you want to track your refund status, you can use the IRS “Where’s My Refund?” tool. This will give you up-to-date information on whether your refund is being processed, under review, or delayed.

Source:www.inquisitr.com