Onsemi Q1 2025 Revenue Decline has caused a significant dip in the company’s stock price, leading to concerns among investors. The maker of power and sensing technology chips reported a 22% year-over-year drop in its first-quarter revenue, which fell to $1.45 billion. This decline was seen across all three business segments, particularly within the automotive sector, where sales dropped by 26%. Despite these challenges, Onsemi still managed to beat analysts’ earnings expectations.

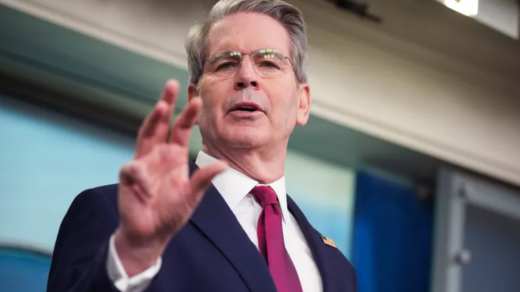

The company’s CEO, Hassane El-Khoury, mentioned during a call with investors that “customers remain cautious,” acknowledging the tough macroeconomic conditions. He also pointed out that while Onsemi has strategically used pricing to maintain or even increase its market share in specific areas, it expects a continued low-single-digit decline in some parts of its business in the near future. Despite this, Onsemi’s free cash flow saw a massive improvement, surging by nearly 75% to $454.7 million.

Onsemi Q1 2025 Revenue Decline: Impact on Automotive Sales

The Onsemi Q1 2025 revenue decline hit the automotive segment the hardest, with a sharp 26% decrease in sales. This drop is a clear indication that the automotive industry, a significant market for Onsemi, is facing challenges. Customers in this sector remain cautious about making large purchases, a trend that the company is monitoring closely. The impact on automotive sales shows how sensitive the industry can be to macroeconomic pressures.

Onsemi Q1 2025 Revenue Decline: A Tough Outlook for the Future

Looking ahead, the Onsemi Q1 2025 revenue decline has led the company to provide cautious guidance for the upcoming quarter. Onsemi expects earnings per share (EPS) for Q2 2025 to range between $0.48 and $0.58, with revenue projections falling between $1.4 billion and $1.5 billion. While analysts had forecasted slightly higher numbers, Onsemi’s cautious outlook reflects the uncertainty in the market. Some analysts believe that Onsemi might even lower its projections further, especially considering the ongoing economic pressures.

Source: www.investopedia.com