Tariffs and US recession risk are now at the center of economic conversations following sweeping trade policy changes introduced by President Donald Trump this week. On Wednesday, the president rolled out a 10% baseline tariff, along with additional country-specific import taxes. These new measures come on top of previously imposed duties on steel, aluminum, and cars.

Trump stated that the goal of these tariffs is to revive domestic manufacturing and attract business investment back to American soil, while also generating additional revenue for the federal budget.

To help put these changes into context, let’s break down what they could mean for the economy and your wallet.

Tariffs and US Recession Risk: How Big Are the Changes?

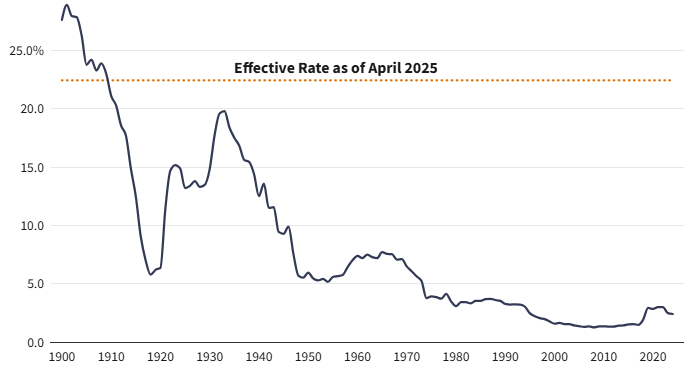

One way to measure the scale of these new policies is by looking at the effective tariff rate, which reflects the total tax burden placed on all imported goods. At the beginning of Trump’s term, this rate was just 2.4%. However, following the announcement of these “reciprocal” tariffs, economists now estimate that number will jump significantly — with most projections falling between 20% and 30%.

According to research published this week by the Yale Budget Lab, the new total effective tariff rate is set to climb to over 22%. That includes 11.5% from the latest round of tariffs alone — marking the highest rate since 1909.

Tariffs and US Recession Risk: What It Means for You

Higher tariffs mean importers face increased costs, which are typically passed on to consumers. This results in noticeable price hikes on everyday goods. The Yale Budget Lab projects that, on average, U.S. households may face an extra $3,800 in annual costs due to these trade policies.

Not all products will be affected equally. Items like leather goods and apparel are expected to see the steepest price increases.

Beyond household budgets, tariffs and US recession risk go hand in hand, according to many economists. These policies may not just cool consumer spending but also hinder overall economic growth, potentially tipping the country toward a recession.

President Trump has acknowledged the likelihood of short-term discomfort, stating that such sacrifices are necessary for a long-term economic reset. But experts warn that the repercussions may extend far beyond temporary pain, dragging on America’s GDP and threatening financial stability for years ahead.

Source: www.investopedia.com