Trump tariffs impact on stock market has triggered waves of concern across financial markets and households alike. With newly imposed tariffs, fears of rising prices and plunging stocks have taken center stage. The market has already felt the shock, losing trillions within days of the announcement.

It’s not just Wall Street bearing the brunt—consumers, especially low-income families, are expected to feel the pinch. Everyday essentials are set to become more expensive due to increased import taxes and retaliatory actions from trade partners.

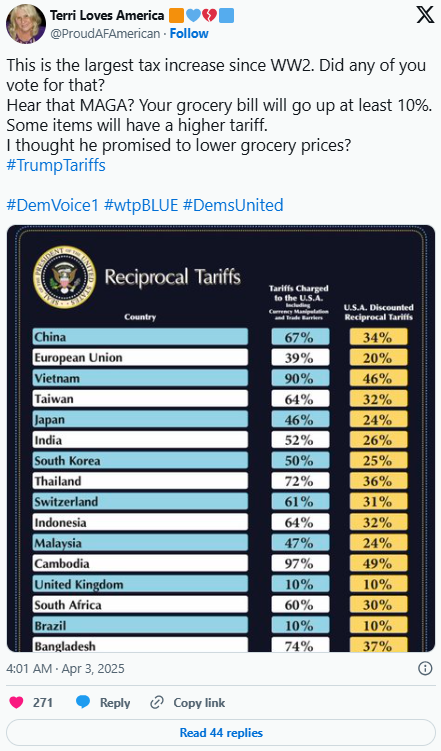

President Trump has introduced a base tariff rate of 10%, with potential hikes up to 60%. Some economists suspect there may be a deliberate move to destabilize the economy to push for higher interest rates—a claim Trump has strongly denied. Nonetheless, whispers of a J-curve reset are circulating.

Trump tariffs impact on stock market and daily living

These tariffs will likely hit low-income households the hardest. Prices of groceries, clothing, and household items are expected to rise rapidly. Experts are urging people to stock up now—before the new prices kick in.

Planning to buy a car or home appliances like washers and dryers? Now might be your last chance before the prices shoot up. Once retailers restock with higher-priced imports, consumers will directly absorb the added cost.

A Babson College economics professor warns, “It’s going to touch every part of the economy.” He emphasizes that the ripple effect will hit essential goods first, disproportionately affecting struggling families.

Trump tariffs impact on stock market and global response

The keyword here is reciprocity. Countries like China have already responded with tariffs of up to 15% on U.S. agricultural products. This trade tension could spiral further, escalating costs across the board.

Perishable goods will be affected first, with supermarkets quickly reflecting the price hikes. Following closely behind will be electronics, shoes, furniture, and clothing—with overall price increases estimated at up to 17%.

John Breyault of the National Consumers League predicts that low-income households may have to shell out nearly $980 more annually just to maintain their current standard of living.

While the administration says the goal is to rebalance the economy, the Trump tariffs impact on stock market and consumer prices tells a different story—one where the financial burden trickles down to those who can least afford it.

Source: www.inquisitr.com